Back

Cowry Mobile App and Card

Cowry is a payment platform that supports the use of wallet and card to pay for bus

Cowry Mobile App and Card

Cowry is a payment platform that supports the use of wallet and card to pay for bus

What I Did

Product Design

UX Research

Ux Strategy

Interactive Prototyping

Platform

Mobile

Year

2020

Industry

Financial Service

B2C

B2B

Transport tech

Product Overview

Cowry is a payment platform that supports the use of wallet and card to pay for bus trips, topup wallet and check bus transactions. The major goal is to topup wallet-reduce cash transaction.

I led the entire mobile experience from concept to launch. I contributed to the UX Research and acted as brand designer to elevate Cowry’s brand and the overall look and feel to craft a delightful experience

We designed a mobile solution and card that was launched and led to 1.5million downloads and an active 300,000 daily users which has increased revenue assurance.

Who Is The Product For?

The product is for two sets of users; tech savy and non tech savy users, to pay for their bus trips using their mobile wallet or card.

Non-Tech Savy

Users who don’t use mobile data. They don’t have access to mobile phones.

Tech Savy

These set of users make use of

mobile app and have accesss to

internet. They will use the mobile

app to the fullest.

Product Problems

Transactions was done in an informal way (Cash based transactions). Hence, resulting to poor account management and absence of data bank to guide decision making.

Goal

The primary goal was to reduce cash-base transactions in transport operation in order to protect stakeholders’ interest, improve contact tracing, and protect commuters on their daily trips around Lagos. This strategic move helped improve the lives of Lagosians and increase easy movement for commuters in Lagos.

Understanding the Users

The first step was to understand what users were going through while trying to pay for a bus ticket manually. Given that this was an entirely new product to be introduced in Nigeria for the first time, we needed to get our facts right.

So to make sure we were solving the right problem and validate our assumptions we kicked off by conducting an intensive primary research.

Understanding the Users

The first step was to understand what users were going through while trying to pay for a bus ticket manually. Given that this was an entirely new product to be introduced in Nigeria for the first time, we needed to get our facts right.

So to make sure we were solving the right problem

and validate assumptions we kicked off by conducting an intensive primary research.

Qualitative Research

I carried out three types of qualitative research in other to gather data and insights about the problems/motivations, understand current behaviour and sets of users we will be building for.

Observation

I went to the terminals , where I observed what users where doing. I was able to fully understand what users were really doing. And documented what I observed.

I stoped about 50 commuters who were at the terminals, and asked for a quick few minutes of their time. I asked a few questions on what challenges they were facing using both card and app.

Guerrilla Research

I stoped about 50 commuters who were at the terminals, and asked for a quick few minutes of their time. I asked a few questions on what challenges they were facing using both card and app.

We interviewed 10 participants asking them in-view of their bus ticket payment experience.

One-0n-One User

Research Goal

The major goal was to find out what users were currently doing, what were their challenges and painpoints and how could we provide a solution to meet their needs.

We asked structured questions on how users will feel about a cashless payment process and what things they might want to achieve using the solution.

Key Insights From Research

The major goal was to find out what users were currently doing, what were their challenges and painpoints and how could we provide a solution to meet their needs.

We asked structured questions on how users will feel about a cashless payment process and what things they might want to achieve using the solution.

We needed to formalise the informal transactions done by users and also protect stakeholders interest.

60% of users were unbanked while 40% were banked

Creating an financially-inclusive solution that encapsulates all users.

Low internet connectivity, minimal coverage in some places in Lagos state

Create a solution that captures payment regardless of network constraints.

Account management was absent

Users were eager to see their transactions and manage transport trips as well as stakeholders

Absence of data bank

We needed to build a platform that will help users and stakeholders make informed decison

We needed to formalise the informal transactions done by users and also protect stakeholders interest.

60% of users were unbanked while 40% were banked

Creating an financially-inclusive solution that encapsulates all users.

Low internet connectivity, minimal coverage in some places in Lagos state

Create a solution that captures payment regardless of network constraints.

Account management was absent

Users were eager to see their transactions and manage transport trips as well as stakeholders

Absence of data bank

We needed to build a platform that will help users and stakeholders make informed decison

60% of users were unbanked while 40% were banked

Creating an financially-inclusive solution that encapsulates all users.

Low internet connectivity, minimal coverage in some places in Lagos state

Create a solution that captures payment regardless of network constraints.

Account management was absent

Users were eager to see their transactions and manage transport trips as well as stakeholders

Absence of data bank

We needed to build a platform that will help users and stakeholders make informed decison

Proposed Solution

Upon identifying users’ challenge and implications, we formulated an agile process to create an equitable, useful and enjoyable product. Synced with engineers, product managers and stakeholders to get insights in other to get feedback and know product direction.

The Product features we resulted to were based of the insights we had gotten from users during research on the needs and task users were expected to perform

We created two payment gateway to capture the banked and the unbanked (Using NFC for card and QRcode for mobile app wallet)

Near field communication was a medium to capture offline transactions for users who did not use high ended mobile devices and also were unbanked and also to solve the issue of low network connectivity

The mobile app will serve as the online mood of payment, for the banked

The main goal and objective was to keep things as simple as possible, due to kind of users we were building for. These payment processes are created in other to create a seamless way of commuting.

Proposed Solution

Upon identifying users’ challenge and implications, we formulated an agile process to create an equitable, useful and enjoyable product. Synced with engineers, product managers and stakeholders to get insights in other to get feedback and know product direction.

The Product features we resulted to were based of the insights we had gotten from users during research on the needs and task users were expected to perform.

We created two payment gateway to capture the banked and the unbanked (Using NFC for card and QRcode for mobile app wallet)

Near field communication was a medium to capture offline transactions for users who did not use high ended mobile devices and also were unbanked and also to solve the issue of low network connectivity

The mobile app will serve as the online mood of payment, for the banked

The main goal and objective was to keep things as simple as possible, due to kind of users we were building for. These payment processes are created in other to create a seamless way of commuting.

Ideation

Now that we had a very good understanding what user challenge and implications were, we were set out to solve these problems in an agile way. Synced with engineers, product managers and stakeholders to get insights in other to get feedback and know product direction.

Based of the UX Research carried out and Identifying key user problems we were able to identify key features which will aid user experience for the mobile app

Ensuring users are able to effectively topup their wallet through integrating with different payent gateways

Users are able to Pay for their bus trip easily by scanning Qr code pasted on the bus

Users are able to see their bus transactions, card transactions and wallet transactions on the app

Users are also able to find nearby terminals using the mobile app

Users are also able to redeem unused tickets

However, our core and primary focus which we tackled first was Topup wallet and Pay with Phone given that this was one of the driving force of our success metrics, for a user to able to pay for their bus trip easily using a mobile wallet which will increase customer satisfaction and and also increase revenue assurance for the business.

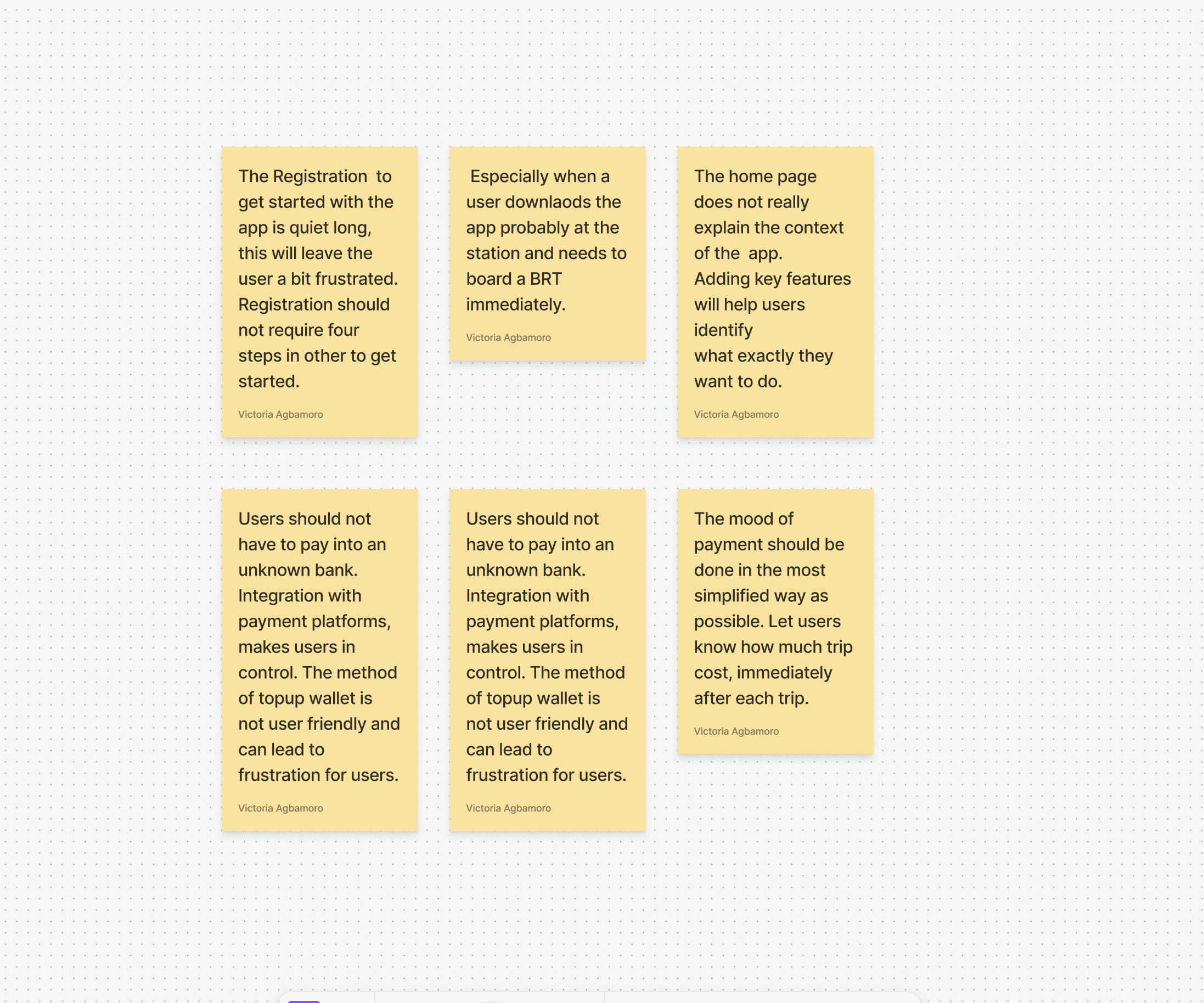

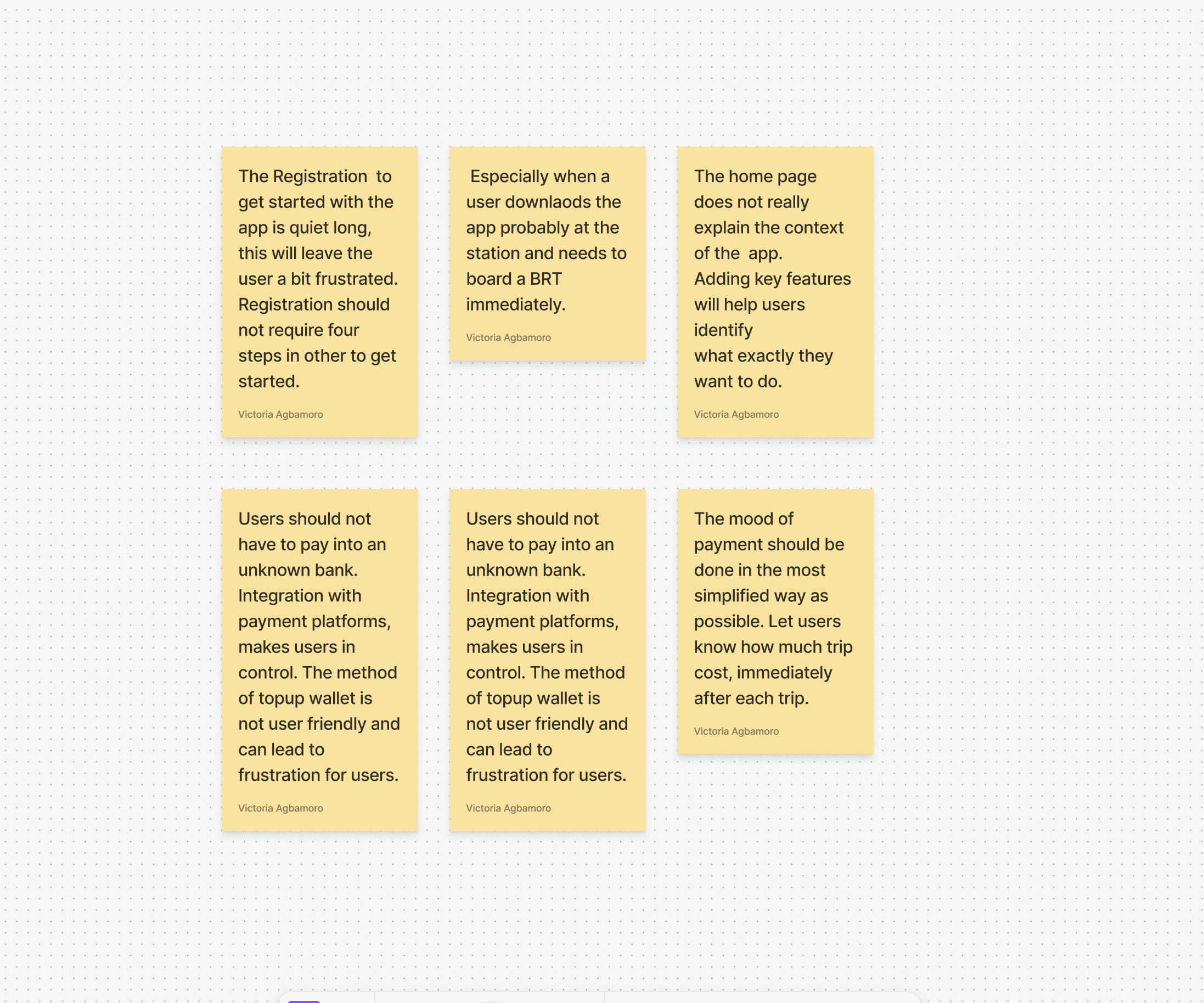

First Iterated Screen

With the launch of the first iterated design, there were some challenges which was hindering users from completely performing their expected task such as sucessfully registering on the app and gping to perform a main action of top-up their wallet to pay for bus trip, which was hindering the success metrics and not encouraging the app usuage and retention.

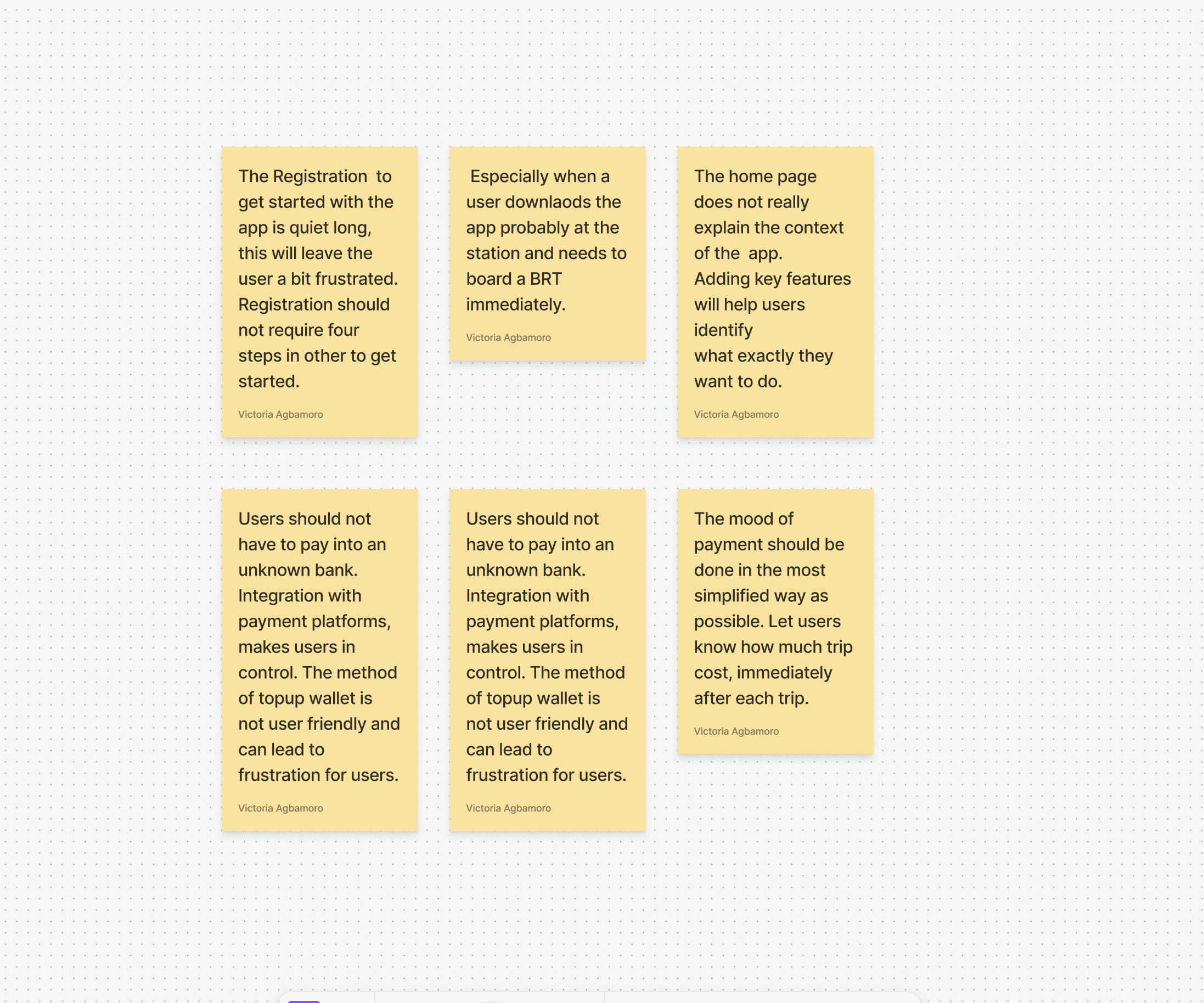

Insights From First Iterated Screen

Information Architecture

Designed a new information architecture to capture the use cases for the new experience

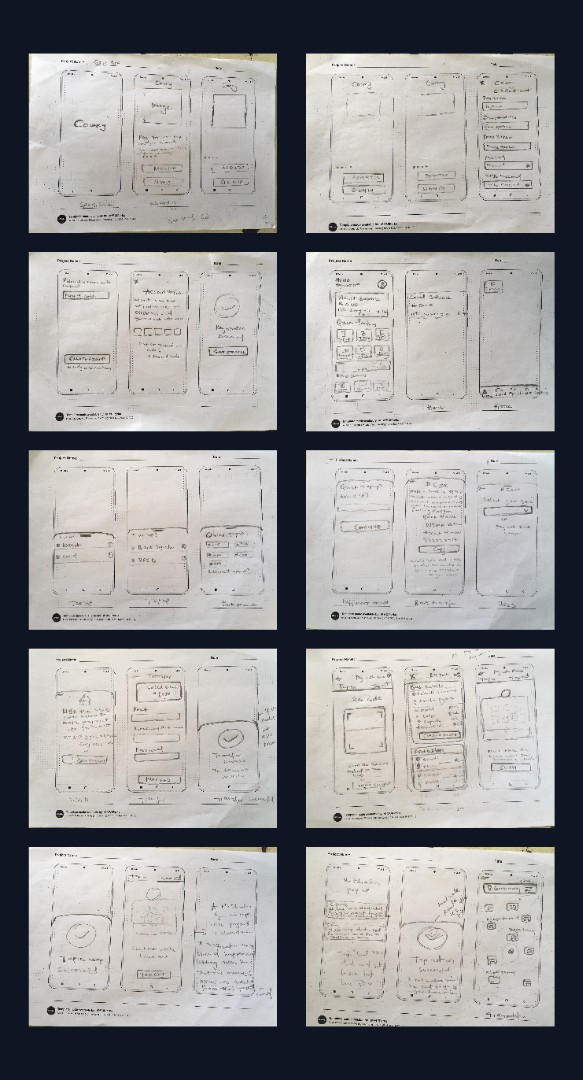

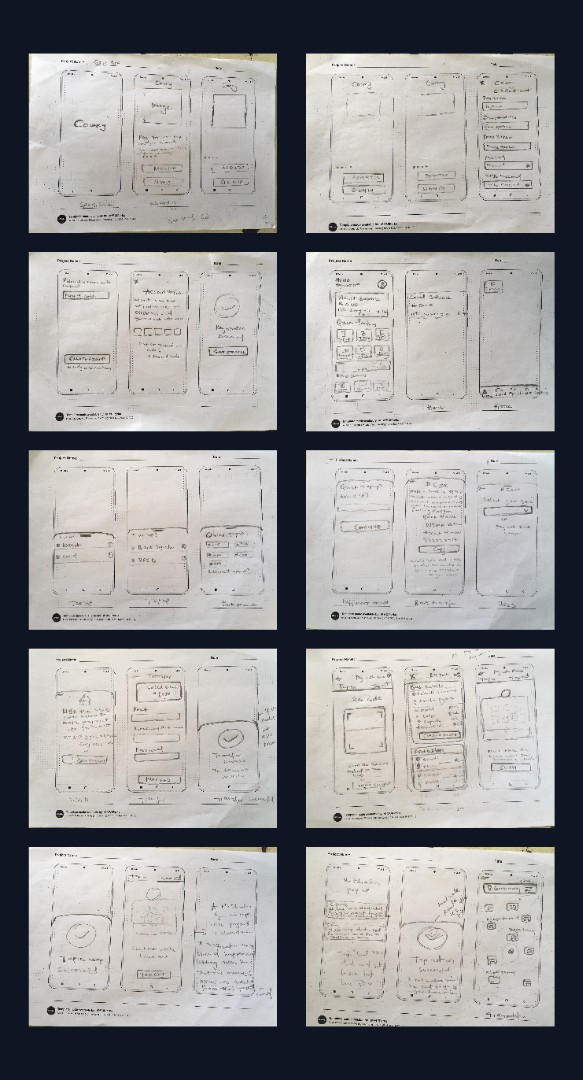

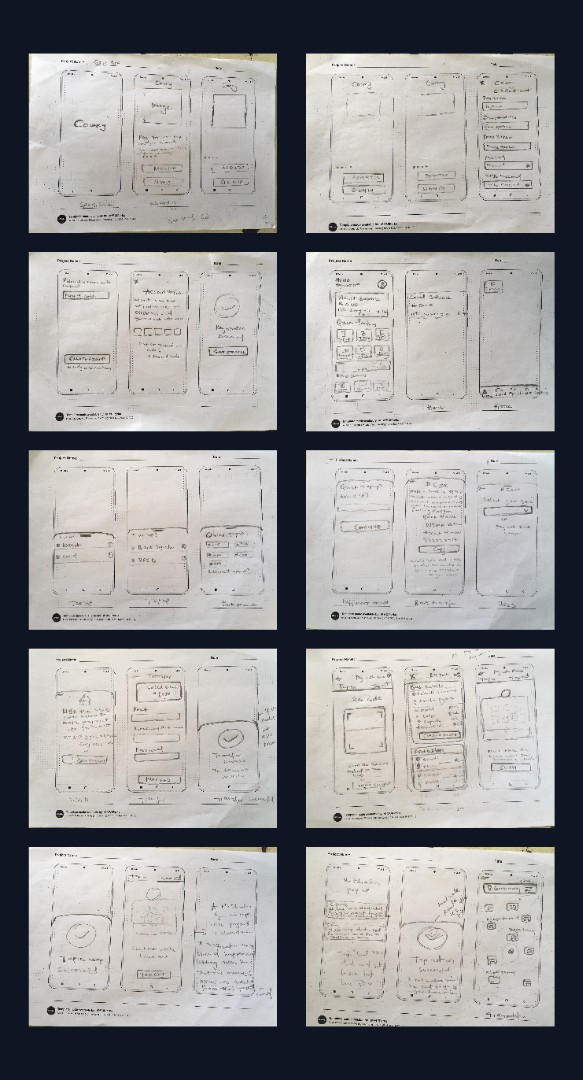

Paper Sketch

Now that we had a very good understanding what user challenge and implications were, we were set out to solve these problems in an agile way. Synced with engineers, product managers and stakeholders to get insights in other to get feedback and know product direction. I started sketching out ideas based on the insights from research.

Design Solution

Once the wireframe was tested, we started bringing the designs to life by adding colors and Icons to give a visual representation of the app

Onboarding Screen

Topup Wallet Process

User research revealed that the wallet top-up was a critical feature, so we made it more prominent in the interface to ensure users could quickly add funds and seamlessly pay for their bus tickets.

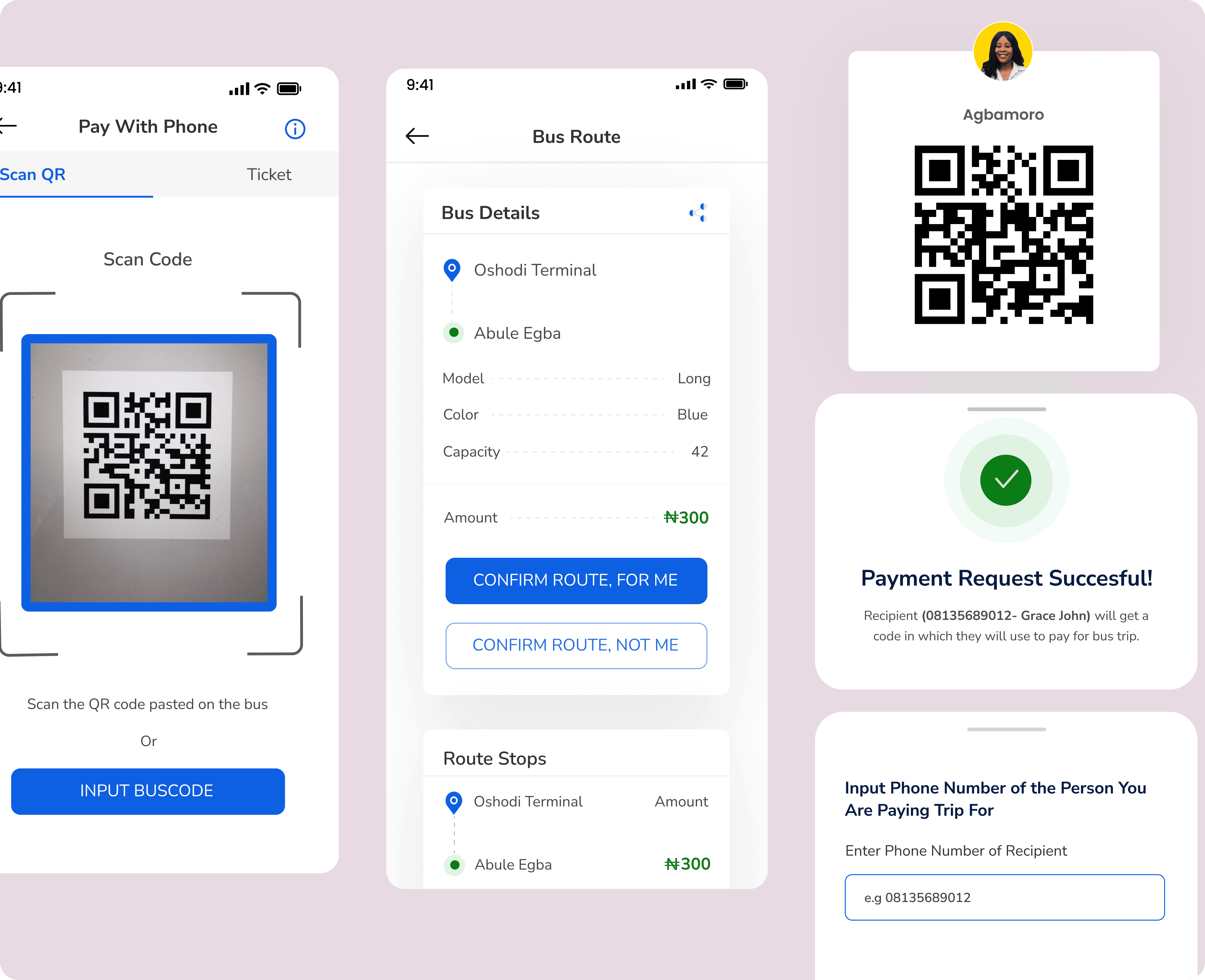

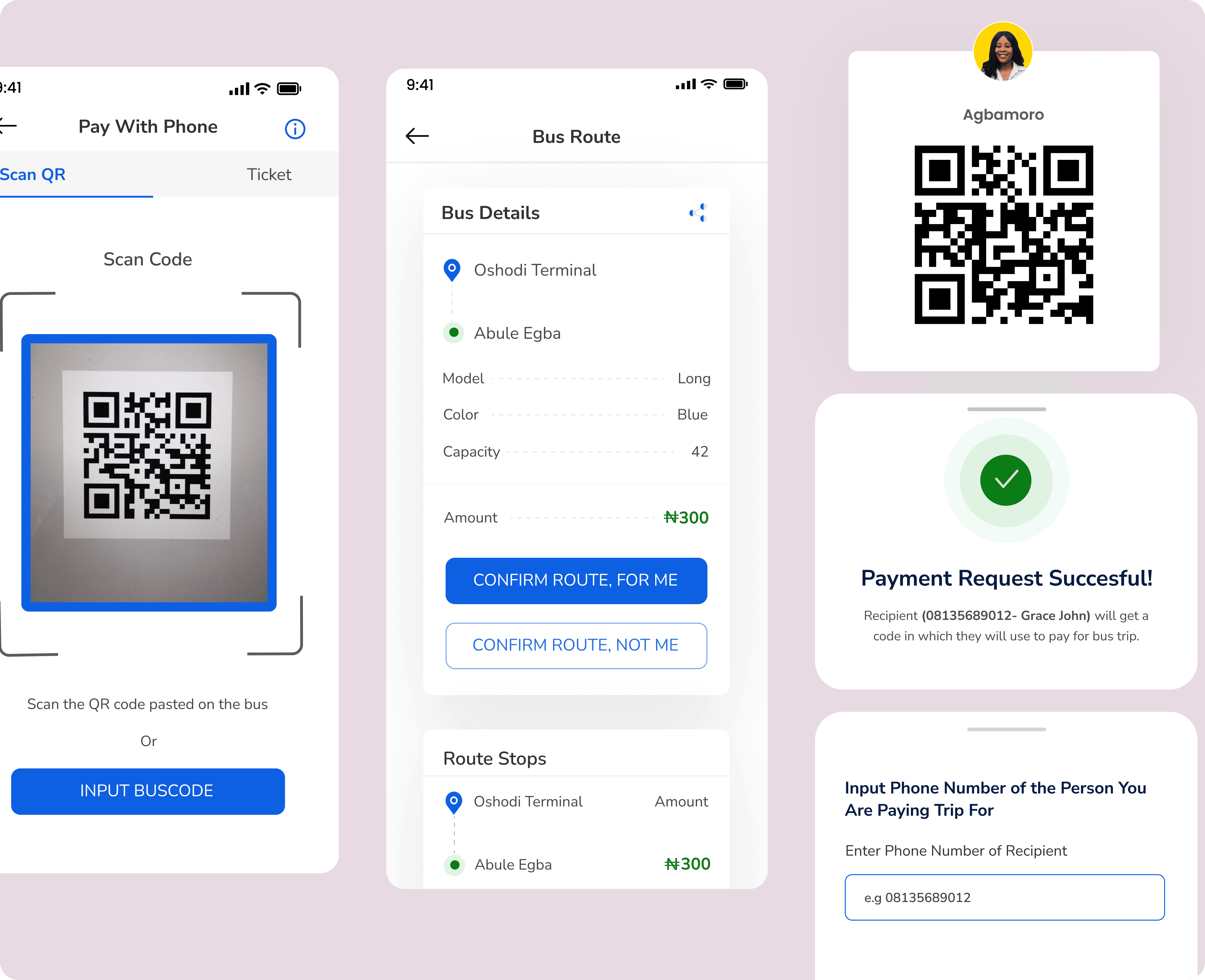

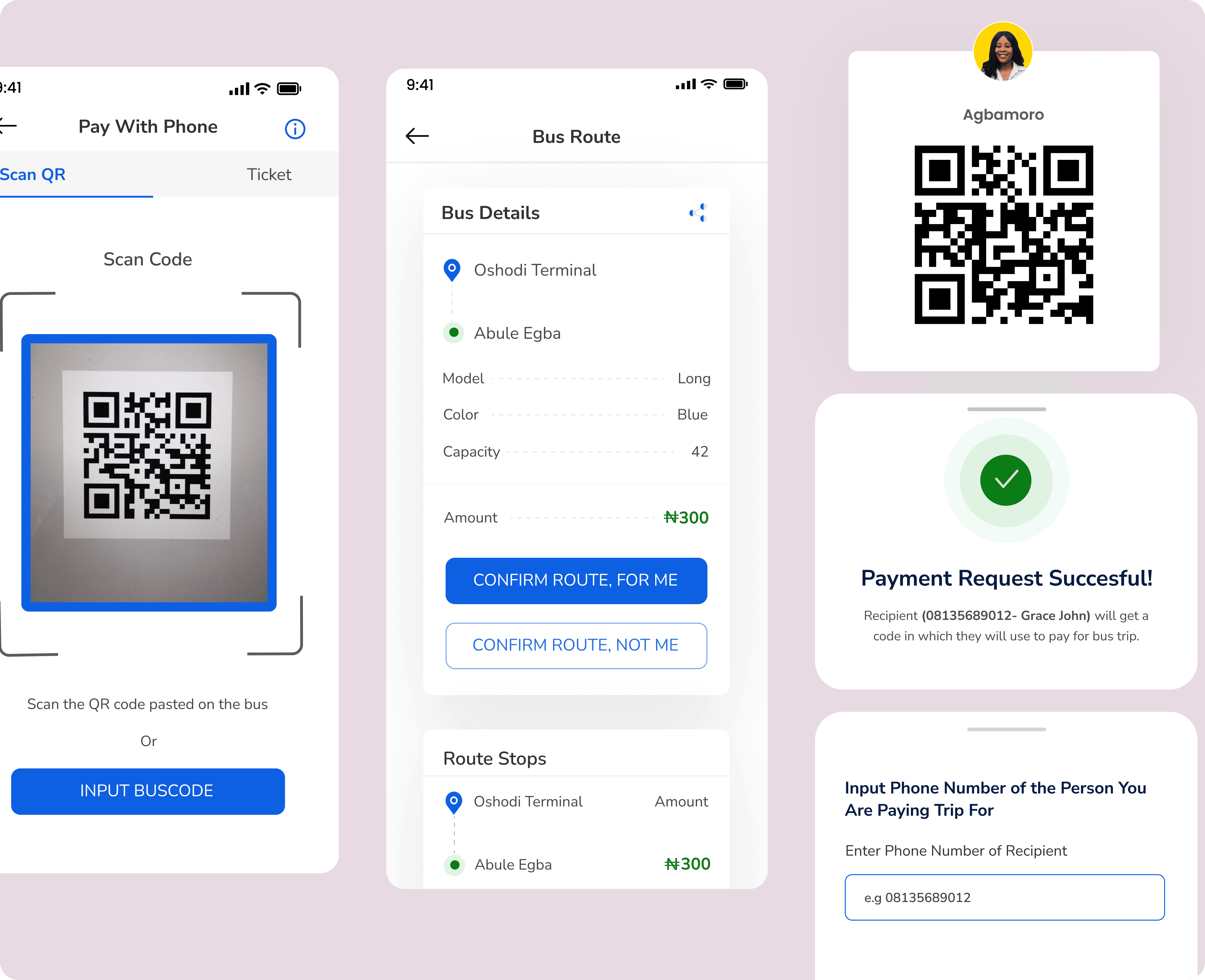

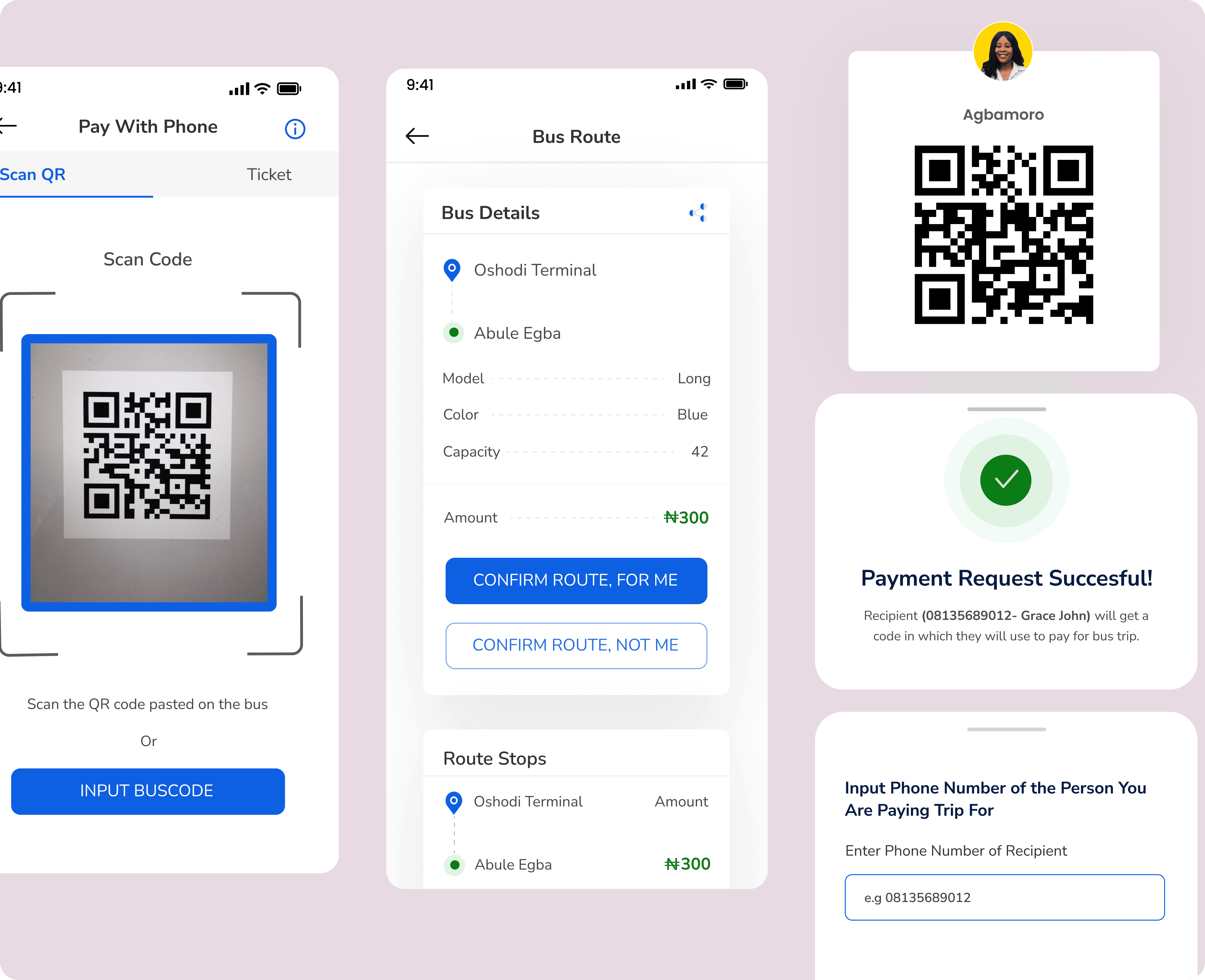

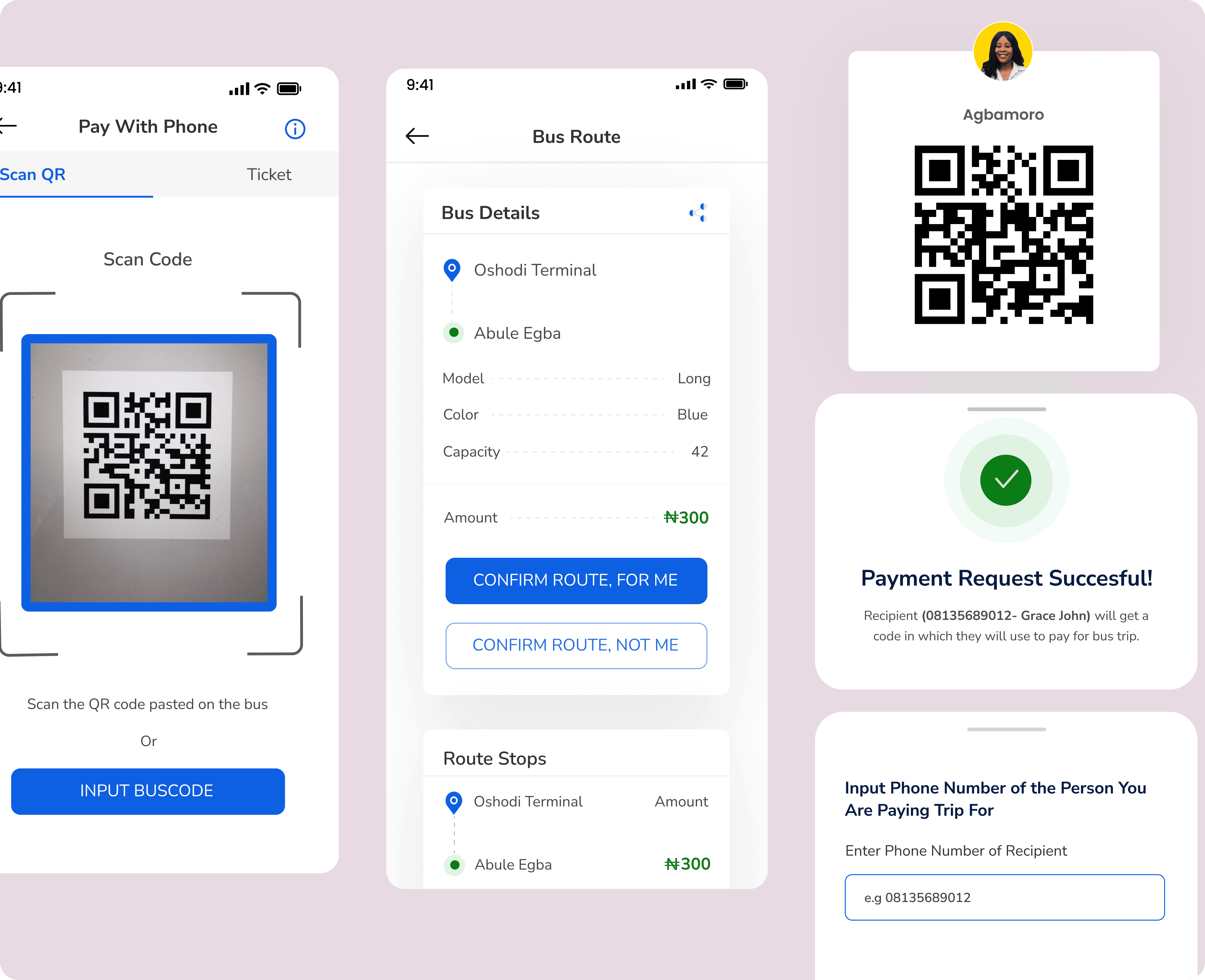

Pay with Phone

Once funds are added to the wallet, users can simply scan the QR code on the bus to pay for their ticket, or conveniently purchase a ticket on behalf of someone else.

9:41

Pay With Phone

Scan QR

Ticket

Scan Code

Scan the QR code pasted on the bus

Or

INPUT BUSCODE

Bus Route

9:41

Oshodi Terminal

Abule Egba

Model

Long

Color

Blue

Capacity

42

Amount

300

CONFIRM ROUTE, FOR ME

CONFIRM ROUTE, NOT ME

Bus Details

Agbamoro

COPY ACCOUNT NUMBER

Payment Request Succesful!

Recipient (08135689012- Grace John) will get a code in which they will use to pay for bus trip.

CONTINUE

YES, FOR ME

Input Phone Number of the Person You Are Paying Trip For

Enter Phone Number of Recipient

e.g 08135689012

CONTINUE

MacBook Pro - 34.png

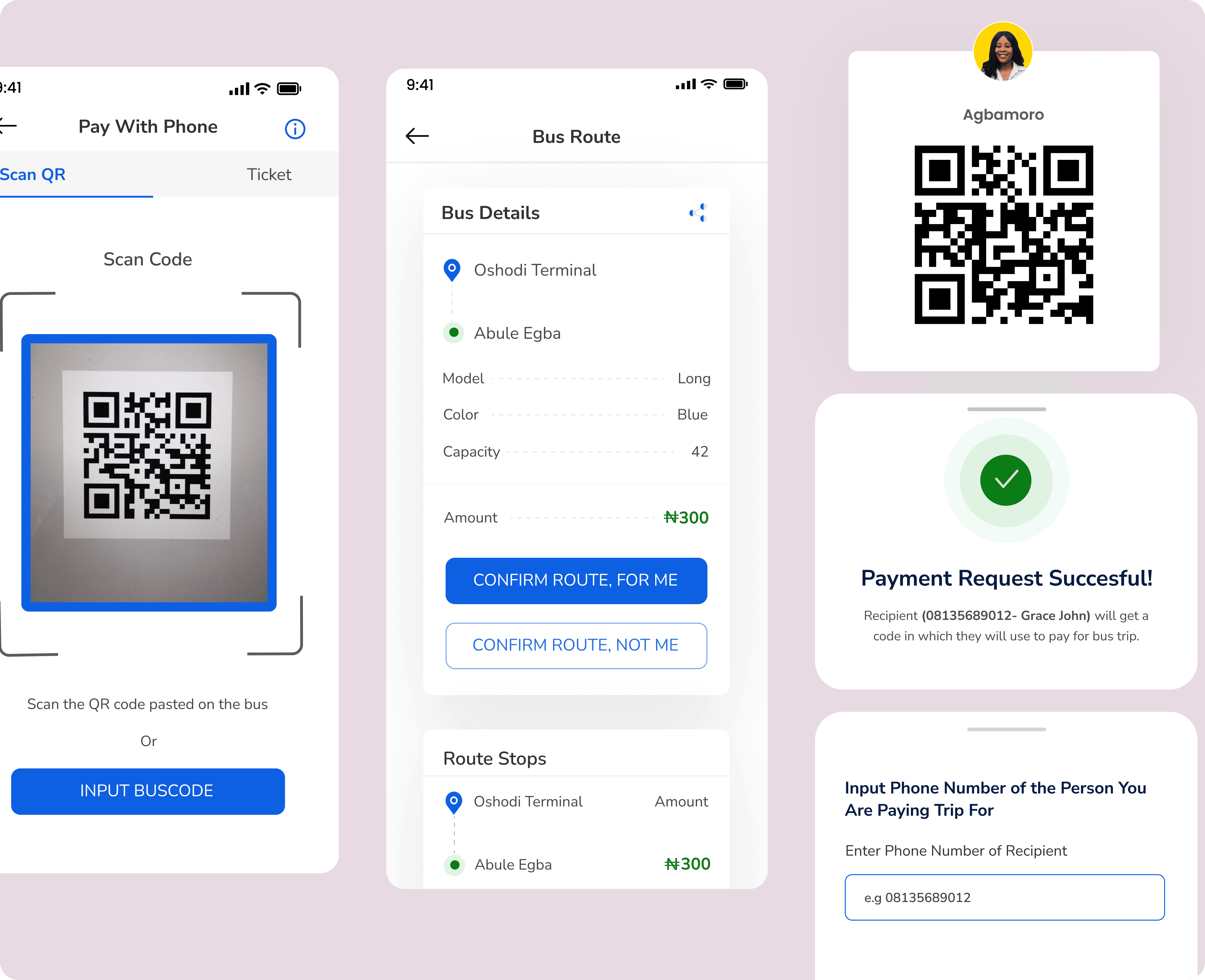

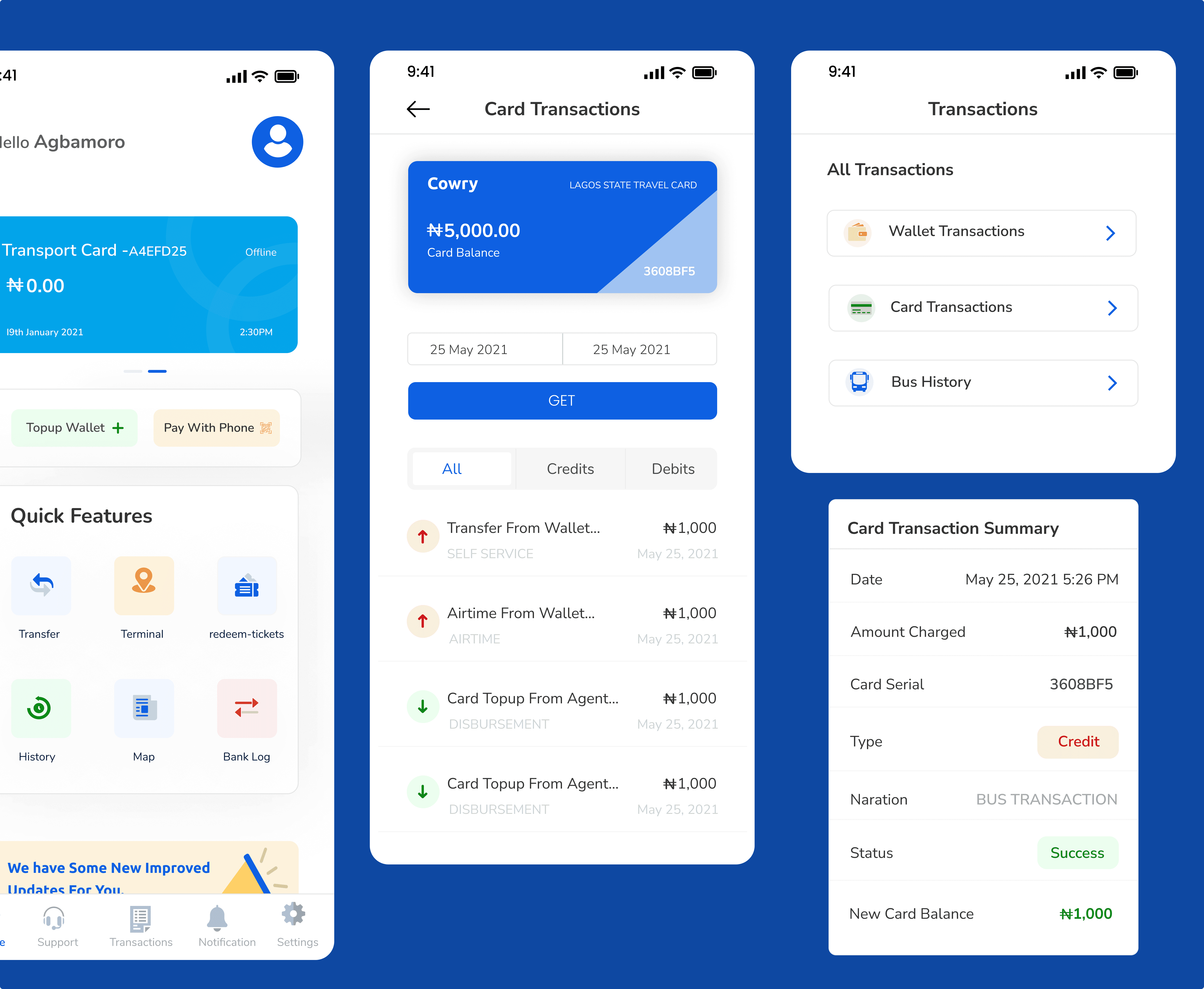

Card Transaction (Offline Transaction)

Since we were designing for two types of users, we needed to ensure both groups were included. Some users were not online users, which is why we designed an offline card to accommodate them. All card transactions are also synced to the mobile app, where users can view their transaction history

Challenges and Key Learnings

The challenges encountered during this project was with Data. Because this project was different and newly developed in Nigeria, we had to conduct both primary and secondary data gathering.

Most of secondary data were adapted to fit the Nigerian market, while the primary data include a mixed methodologies of interviews/focus groups and questionnaires/survey to ensure data validity and reliability. Overall, we were able to assess these data to apply it during product development.

We currently have 3.5million users and an active 300,000 daily users which has increased revenue assurance, contact tracing, trip planning and management and easy payment process.

We achieved a milestone of over 15 billion naira in transactions in 2022.

VICTORIA AGBAMORO

Cowry Mobile App and Card

Cowry is a payment platform that supports the use of wallet and card to pay for bus

Let’s make it happen

Contact me today!

Let’s make it happen

Contact me today!

VICTORIA AGBAMORO

Back

Cowry Mobile App and Card

Cowry is a payment platform that supports the use of wallet and card to pay for bus

Cowry Mobile App and Card

Cowry is a payment platform that supports the use of wallet and card to pay for bus

What I Did

Product Design

UX Research

Ux Strategy

Interactive Prototyping

Platform

Mobile

Year

2020

Industry

Financial Service

B2C

B2B

Transport tech

Product Overview

Cowry is a payment platform that supports the use of wallet and card to pay for bus trips, topup wallet and check bus transactions. The major goal is to topup wallet-reduce cash transaction.

I led the entire mobile experience from concept to launch. I contributed to the UX Research and acted as brand designer to elevate Cowry’s brand and the overall look and feel to craft a delightful experience

We designed a mobile solution and card that was launched and led to 1.5million downloads and an active 300,000 daily users which has increased revenue assurance.

Who Is The Product For?

The product is for two sets of users; tech savy and non tech savy users, to pay for their bus trips using their mobile wallet or card.

Non-Tech Savy

Users who don’t use mobile data. They don’t have access to mobile phones.

Tech Savy

These set of users make use of

mobile app and have accesss to

internet. They will use the mobile app to the fullest.

Product Problems

Transactions was done in an informal way (Cash based transactions). Hence, resulting to poor account management and absence of data bank to guide decision making.

Goal

The primary goal was to reduce cash-base transactions in transport operation in order to protect stakeholders’ interest, improve contact tracing, and protect commuters on their daily trips around Lagos. This strategic move helped improve the lives of Lagosians and increase easy movement for commuters in Lagos.

Understanding the Users

The first step was to understand what users were going through while trying to pay for a bus ticket manually. Given that this was an entirely new product to be introduced in Nigeria for the first time, we needed to get our facts right.

So to make sure we were solving the right problem and validate our assumptions we kicked off by conducting an intensive primary research.

Understanding the Users

The first step was to understand what users were going through while trying to pay for a bus ticket manually. Given that this was an entirely new product to be introduced in Nigeria for the first time, we needed to get our facts right.

So to make sure we were solving the right problem

and validate assumptions we kicked off by conducting an intensive primary research.

Qualitative Research

I carried out three types of qualitative research in other to gather data and insights about the problems

/motivations, understand current behaviour and sets of users we will be building for.

Observation

I went to the terminals , where I observed what users where doing. I was able to fully understand what users were really doing. And documented what I observed.

I stoped about 50 commuters who were at the terminals, and asked for a quick few minutes of their time. I asked a few questions on what challenges they were facing using both card and app.

Guerrilla Research

I stoped about 50 commuters who were at the terminals, and asked for a quick few minutes of their time. I asked a few questions on what challenges they were facing using both card and app.

We interviewed 10 participants asking them in-view of their bus ticket payment experience.

One-0n-One User

Research Goal

The major goal was to find out what users were currently doing, what were their challenges and painpoints and how could we provide a solution to meet their needs.

We asked structured questions on how users will feel about a cashless payment process and what things they might want to achieve using the solution.

Key Insights From Research

The major goal was to find out what users were currently doing, what were their challenges and painpoints and how could we provide a solution to meet their needs.

We asked structured questions on how users will feel about a cashless payment process and what things they might want to achieve using the solution.

We needed to formalise the informal transactions done by users and also protect stakeholders interest.

60% of users were unbanked while 40% were banked

Creating an financially-inclusive solution that encapsulates all users.

Low internet connectivity, minimal coverage in some places in Lagos state

Create a solution that captures payment regardless of network constraints.

Account management was absent

Users were eager to see their transactions and manage transport trips as well as stakeholders

Absence of data bank

We needed to build a platform that will help users and stakeholders make informed decison

We needed to formalise the informal transactions done by users and also protect stakeholders interest.

60% of users were unbanked while 40% were banked

Creating an financially-inclusive solution that encapsulates all users.

Low internet connectivity, minimal coverage in some places in Lagos state

Create a solution that captures payment regardless of network constraints.

Account management was absent

Users were eager to see their transactions and manage transport trips as well as stakeholders

Absence of data bank

We needed to build a platform that will help users and stakeholders make informed decison

60% of users were unbanked while 40% were banked

Creating an financially-inclusive solution that encapsulates all users.

Low internet connectivity, minimal coverage in some places in Lagos state

Create a solution that captures payment regardless of network constraints.

Account management was absent

Users were eager to see their transactions and manage transport trips as well as stakeholders

Absence of data bank

We needed to build a platform that will help users and stakeholders make informed decison

Proposed Solution

Upon identifying users’ challenge and implications, we formulated an agile process to create an equitable, useful and enjoyable product. Synced with engineers, product managers and stakeholders to get insights in other to get feedback and know product direction.

The Product features we resulted to were based of the insights we had gotten from users during research on the needs and task users were expected to perform

We created two payment gateway to capture the banked and the unbanked (Using NFC for card and QRcode for mobile app wallet)

Near field communication was a medium to capture offline transactions for users who did not use high ended mobile devices and also were unbanked and also to solve the issue of low network connectivity

The mobile app will serve as the online mood of payment, for the banked

The main goal and objective was to keep things as simple as possible, due to kind of users we were building for. These payment processes are created in other to create a seamless way of commuting.

Proposed Solution

Upon identifying users’ challenge and implications, we formulated an agile process to create an equitable, useful and enjoyable product. Synced with engineers, product managers and stakeholders to get insights in other to get feedback and know product direction.

The Product features we resulted to were based of the insights we had gotten from users during research on the needs and task users were expected to perform.

We created two payment gateway to capture the banked and the unbanked (Using NFC for card and QRcode for mobile app wallet)

Near field communication was a medium to capture offline transactions for users who did not use high ended mobile devices and also were unbanked and also to solve the issue of low network connectivity

The mobile app will serve as the online mood of payment, for the banked

The main goal and objective was to keep things as simple as possible, due to kind of users we were building for. These payment processes are created in other to create a seamless way of commuting.

Ideation

Now that we had a very good understanding what user challenge and implications were, we were set out to solve these problems in an agile way. Synced with engineers, product managers and stakeholders to get insights in other to get feedback and know product direction.

Based of the UX Research carried out and Identifying key user problems we were able to identify key features which will aid user experience for the mobile app

Ensuring users are able to effectively topup their wallet through integrating with different payent gateways

Users are able to Pay for their bus trip easily by scanning Qr code pasted on the bus

Users are able to see their bus transactions, card transactions and wallet transactions on the app

Users are also able to find nearby terminals using the mobile app

Users are also able to redeem unused tickets

However, our core and primary focus which we tackled first was Topup wallet and Pay with Phone given that this was one of the driving force of our success metrics, for a user to able to pay for their bus trip easily using a mobile wallet which will increase customer satisfaction and and also increase revenue assurance for the business.

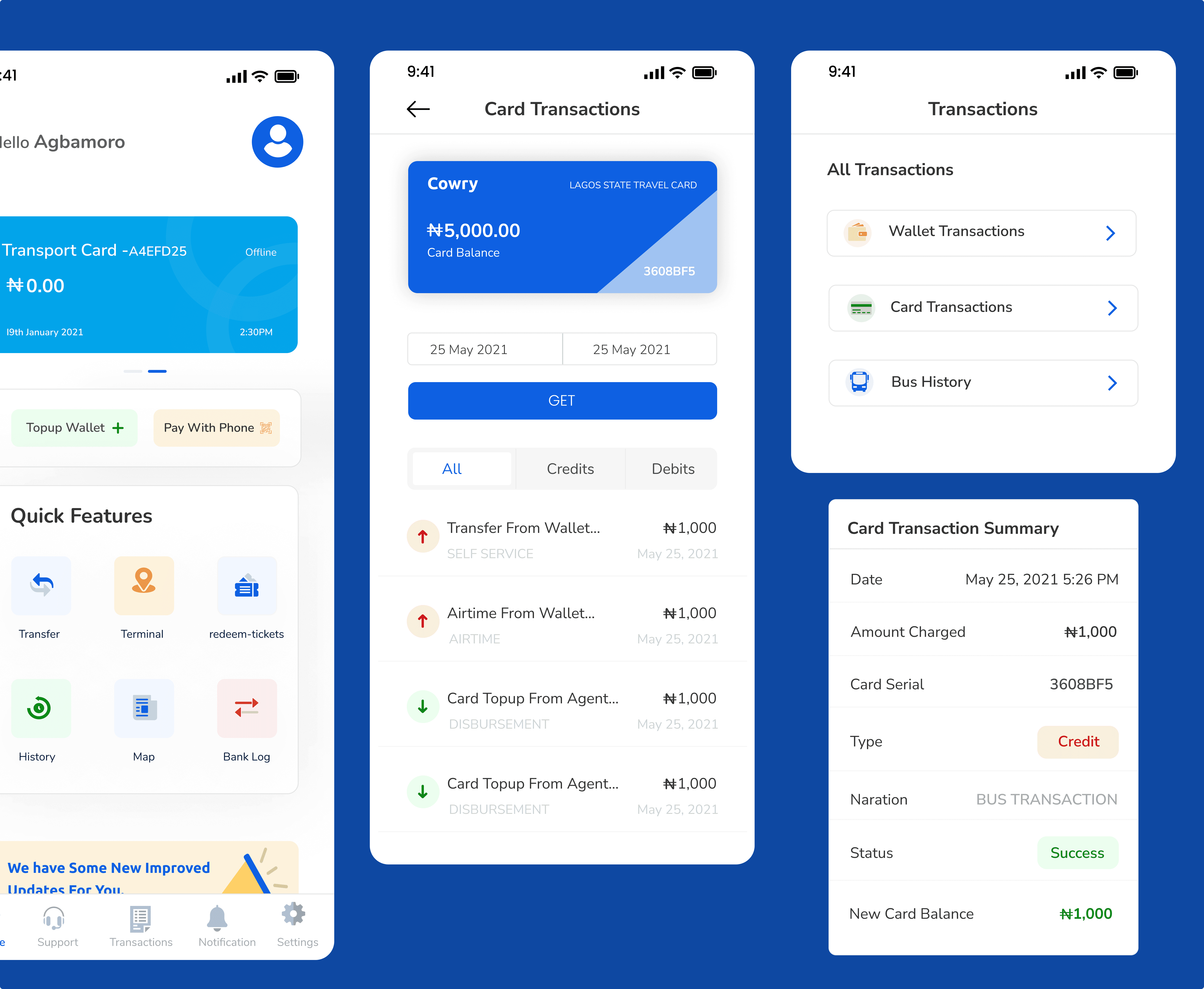

First Iterated Screen

With the launch of the first iterated design, there were some challenges which was hindering users from completely performing their expected task such as sucessfully registering on the app and gping to perform a main action of top-up their wallet to pay for bus trip, which was hindering the success metrics and not encouraging the app usuage and retention.

Insights From First Iterated Screen

Information Architecture

Designed a new information architecture to capture the use cases for the new experience

Paper Sketch

Now that we had a very good understanding what user challenge and implications were, we were set out to solve these problems in an agile way. Synced with engineers, product managers and stakeholders to get insights in other to get feedback and know product direction. I started sketching out ideas based on the insights from research.

Design Solution

Once the wireframe was tested, we started bringing the designs to life by adding colors and Icons to give a visual representation of the app

Onboarding Screen

Topup Wallet Process

User research revealed that the wallet top-up was a critical feature, so we made it more prominent in the interface to ensure users could quickly add funds and seamlessly pay for their bus tickets.

Pay with Phone

Once funds are added to the wallet, users can simply scan the QR code on the bus to pay for their ticket, or conveniently purchase a ticket on behalf of someone else.

9:41

Pay With Phone

Scan QR

Ticket

Scan Code

Scan the QR code pasted on the bus

Or

INPUT BUSCODE

Bus Route

9:41

Oshodi Terminal

Abule Egba

Model

Long

Color

Blue

Capacity

42

Amount

300

CONFIRM ROUTE, FOR ME

CONFIRM ROUTE, NOT ME

Bus Details

Agbamoro

COPY ACCOUNT NUMBER

Payment Request Succesful!

Recipient (08135689012- Grace John) will get a code in which they will use to pay for bus trip.

CONTINUE

YES, FOR ME

Input Phone Number of the Person You Are Paying Trip For

Enter Phone Number of Recipient

e.g 08135689012

CONTINUE

MacBook Pro - 34.png

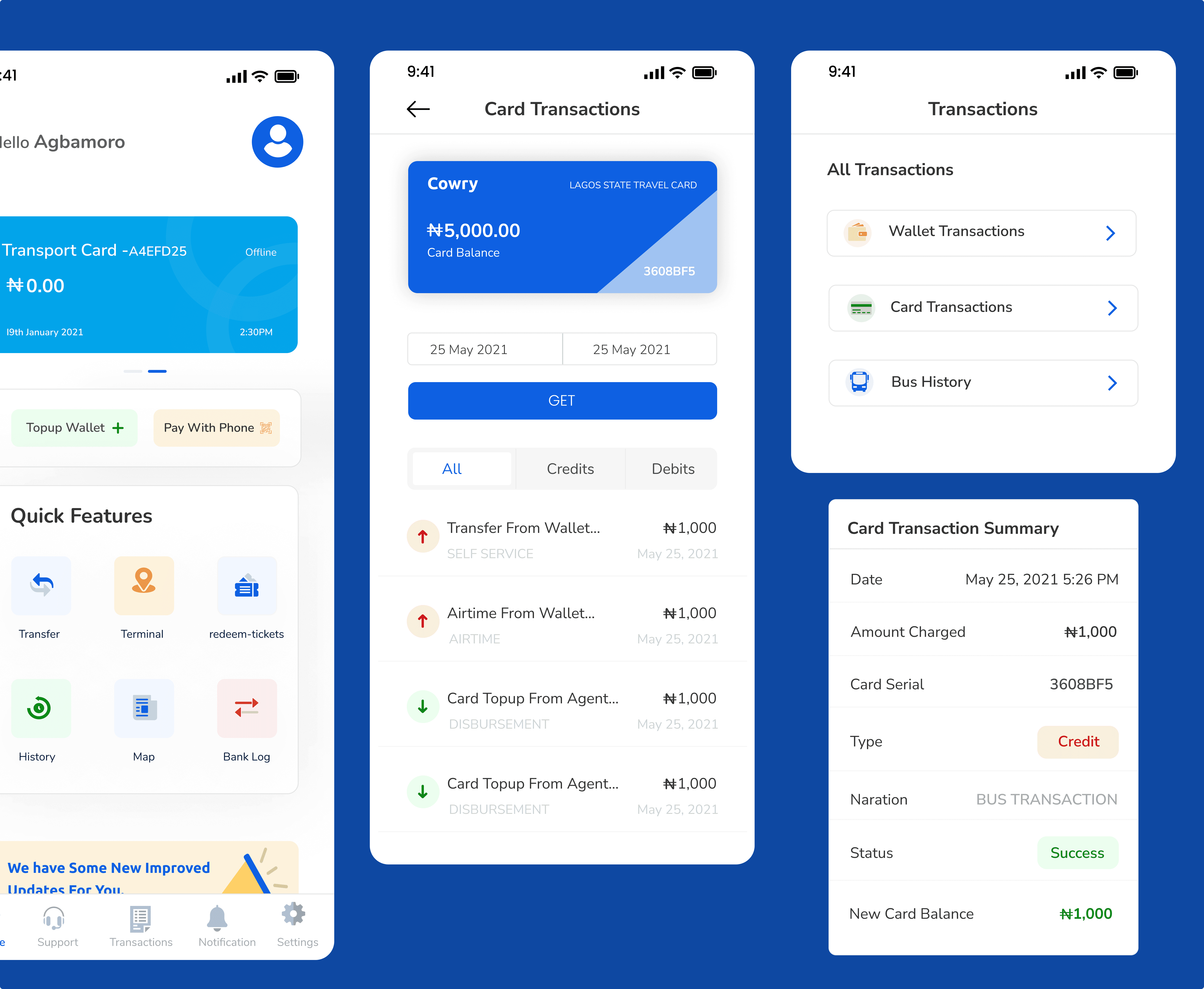

Card Transaction (Offline Transaction)

Since we were designing for two types of users, we needed to ensure both groups were included. Some users were not online users, which is why we designed an offline card to accommodate them. All card transactions are also synced to the mobile app, where users can view their transaction history

Challenges and Key Learnings

The challenges encountered during this project was with Data. Because this project was different and newly developed in Nigeria, we had to conduct both primary and secondary data gathering.

Most of secondary data were adapted to fit the Nigerian market, while the primary data include a mixed methodologies of interviews/focus groups and questionnaires/survey to ensure data validity and reliability. Overall, we were able to assess these data to apply it during product development.

We currently have 3.5million users and an active 300,000 daily users which has increased revenue assurance, contact tracing, trip planning and management and easy payment process.

We achieved a milestone of over 15 billion naira in transactions in 2022.

VICTORIA AGBAMORO

Cowry Mobile App and Card

Cowry is a payment platform that supports the use of wallet and card to pay for bus

Let’s make it happen

Contact me today!

Let’s make it happen

Contact me today!

VICTORIA AGBAMORO

Back

Cowry Mobile App and Card

Cowry is a payment platform that supports the use of wallet and card to pay for bus

Cowry Mobile App and Card

Cowry is a payment platform that supports the use of wallet and card to pay for bus

What I Did

Product Design

UX Research

UX Strategy

Interactive Prototyping

Platform

Mobile

Year

2020

Industry

Financial Service

B2C

B2B

Transport tech

Product Overview

Cowry is a payment platform that supports the use of wallet and card to pay for bus trips, topup wallet and check bus transactions. The major goal is to topup wallet-reduce cash transaction.

I led the entire mobile experience from concept to launch. I contributed to the UX Research and acted as brand designer to elevate Cowry’s brand and the overall look and feel to craft a delightful experience.

We designed a mobile solution and card that was launched and led to 1.5million downloads and an active 300,000 daily users which has increased revenue assurance.

Who Is The Product For?

The product is for two sets of users; tech savy and non tech savy users, to pay for their bus trips using their mobile wallet or card.

Non-Tech Savy

Users who don’t use mobile data. They don’t have access to mobile phones.

Tech Savy

These set of users make use of mobile app and have accesss to internet. They will use the mobile

app to the fullest.

Product Problems

Transactions was done in an informal way (Cash based transactions). Hence, resulting to poor account management and absence of data bank to guide decision making.

Goal

The primary goal was to reduce cash-base transactions in transport operation in order to protect stakeholders’ interest, improve contact tracing, and protect commuters on their daily trips around Lagos. This strategic move helped improve the lives of Lagosians and increase easy movement for commuters in Lagos.

Understanding the Users

The first step was to understand what users were going through while trying to pay for a bus ticket manually. Given that this was an entirely new product to be introduced in Nigeria for the first time, we needed to get our facts right.

So to make sure we were solving the right problem and validate our assumptions we kicked off by conducting an intensive primary research.

Understanding the Users

The first step was to understand what users were going through while trying to pay for a bus ticket manually. Given that this was an entirely new product to be introduced in Nigeria for the first time, we needed to get our facts right.

So to make sure we were solving the right problem

and validate assumptions we kicked off by conducting an intensive primary research.

Qualitative Research

I carried out three types of qualitative research in other to gather data and insights about the problems/motivations, understand current behaviour and sets of users we will be building for.

Observation

I went to the terminals , where I observed what users where doing. I was able to fully understand what users were really doing. And documented what I observed.

I stoped about 50 commuters who were at the terminals, and asked for a quick few minutes of their time. I asked a few questions on what challenges they were facing using both card and app.

Guerrilla Research

I stoped about 50 commuters who were at the terminals, and asked for a quick few minutes of their time. I asked a few questions on what challenges they were facing using both card and app.

We interviewed 10 participants asking them in-view of their bus ticket payment experience.

One-0n-One User

Research Goal

The major goal was to find out what users were currently doing, what were their challenges and painpoints and how could we provide a solution to meet their needs.

We asked structured questions on how users will feel about a cashless payment process and what things they might want to achieve using the solution.

Key Insights From Research

The major goal was to find out what users were currently doing, what were their challenges and painpoints and how could we provide a solution to meet their needs.

We asked structured questions on how users will feel about a cashless payment process and what things they might want to achieve using the solution.

We needed to formalise the informal transactions done by users and also protect stakeholders interest.

60% of users were unbanked while 40% were banked

Creating an financially-inclusive solution that encapsulates all users.

Low internet connectivity, minimal coverage in some places in Lagos state

Create a solution that captures payment regardless of network constraints.

Account management was absent

Users were eager to see their transactions and manage transport trips as well as stakeholders

Absence of data bank

We needed to build a platform that will help users and stakeholders make informed decison

We needed to formalise the informal transactions done by users and also protect stakeholders interest.

60% of users were unbanked while 40% were banked

Creating an financially-inclusive solution that encapsulates all users.

Low internet connectivity, minimal coverage in some places in Lagos state

Create a solution that captures payment regardless of network constraints.

Account management was absent

Users were eager to see their transactions and manage transport trips as well as stakeholders

Absence of data bank

We needed to build a platform that will help users and stakeholders make informed decison

60% of users were unbanked while 40% were banked

Creating an financially-inclusive solution that encapsulates all users.

Low internet connectivity, minimal coverage in some places in Lagos state

Create a solution that captures payment regardless of network constraints.

Account management was absent

Users were eager to see their transactions and manage transport trips as well as stakeholders

Absence of data bank

We needed to build a platform that will help users and stakeholders make informed decison

Proposed Solution

Upon identifying users’ challenge and implications, we formulated an agile process to create an equitable, useful and enjoyable product. Synced with engineers, product managers and stakeholders to get insights in other to get feedback and know product direction.

The Product features we resulted to were based of the insights we had gotten from users during research on the needs and task users were expected to perform

We created two payment gateway to capture the banked and the unbanked (Using NFC for card and QRcode for mobile app wallet)

Near field communication was a medium to capture offline transactions for users who did not use high ended mobile devices and also were unbanked and also to solve the issue of low network connectivity

The mobile app will serve as the online mood of payment, for the banked

The main goal and objective was to keep things as simple as possible, due to kind of users we were building for. These payment processes are created in other to create a seamless way of commuting.

Proposed Solution

Upon identifying users’ challenge and implications, we formulated an agile process to create an equitable, useful and enjoyable product. Synced with engineers, product managers and stakeholders to get insights in other to get feedback and know product direction.

The Product features we resulted to were based of the insights we had gotten from users during research on the needs and task users were expected to perform.

We created two payment gateway to capture the banked and the unbanked (Using NFC for card and QRcode for mobile app wallet)

Near field communication was a medium to capture offline transactions for users who did not use high ended mobile devices and also were unbanked and also to solve the issue of low network connectivity

The mobile app will serve as the online mood of payment, for the banked

The main goal and objective was to keep things as simple as possible, due to kind of users we were building for. These payment processes are created in other to create a seamless way of commuting.

Ideation

Now that we had a very good understanding what user challenge and implications were, we were set out to solve these problems in an agile way. Synced with engineers, product managers and stakeholders to get insights in other to get feedback and know product direction.

Based of the UX Research carried out and Identifying key user problems we were able to identify key features which will aid user experience for the mobile app.

Ensuring users are able to effectively topup their wallet through integrating with different payent gateways

Users are able to Pay for their bus trip easily by scanning Qr code pasted on the bus

Users are able to see their bus transactions, card transactions and wallet transactions on the app

Users are also able to find nearby terminals using the mobile app

Users are also able to redeem unused tickets

However, our core and primary focus which we tackled first was Topup wallet and Pay with Phone given that this was one of the driving force of our success metrics, for a user to able to pay for their bus trip easily using a mobile wallet which will increase customer satisfaction and and also increase revenue assurance for the business.

First Iterated Screen

With the launch of the first iterated design, there were some challenges which was hindering users from completely performing their expected task such as sucessfully registering on the app and gping to perform a main action of top-up their wallet to pay for bus trip, which was hindering the success metrics and not encouraging the app usuage and retention.

Insights From First Iterated Screen

Information Architecture

Designed a new information architecture to capture the use cases for the new experience

Paper Sketch

Now that we had a very good understanding what user challenge and implications were, we were set out to solve these problems in an agile way. Synced with engineers, product managers and stakeholders to get insights in other to get feedback and know product direction. I started sketching out ideas based on the insights from research.

Design Solution

Once the wireframe was tested, we started bringing the designs to life by adding colors and Icons to give a visual representation of the app

Onboarding Screen

Topup Wallet Process

User research revealed that the wallet top-up was a critical feature, so we made it more prominent in the interface to ensure users could quickly add funds and seamlessly pay for their bus tickets.

Pay with Phone

Once funds are added to the wallet, users can simply scan the QR code on the bus to pay for their ticket, or conveniently purchase a ticket on behalf of someone else.

9:41

Pay With Phone

Scan QR

Ticket

Scan Code

Scan the QR code pasted on the bus

Or

INPUT BUSCODE

Bus Route

9:41

Oshodi Terminal

Abule Egba

Model

Long

Color

Blue

Capacity

42

Amount

300

CONFIRM ROUTE, FOR ME

CONFIRM ROUTE, NOT ME

Bus Details

Agbamoro

COPY ACCOUNT NUMBER

Payment Request Succesful!

Recipient (08135689012- Grace John) will get a code in which they will use to pay for bus trip.

CONTINUE

YES, FOR ME

Input Phone Number of the Person You Are Paying Trip For

Enter Phone Number of Recipient

e.g 08135689012

CONTINUE

MacBook Pro - 34.png

Card Transaction (Offline Transaction)

Since we were designing for two types of users, we needed to ensure both groups were included. Some users were not online users, which is why we designed an offline card to accommodate them. All card transactions are also synced to the mobile app, where users can view their transaction history

Challenges and Key Learnings

The challenges encountered during this project was with Data. Because this project was different and newly developed in Nigeria, we had to conduct both primary and secondary data gathering.

Most of secondary data were adapted to fit the Nigerian market, while the primary data include a mixed methodologies of interviews/focus groups and questionnaires/survey to ensure data validity and reliability. Overall, we were able to assess these data to apply it during product development.

We currently have 3.5million users and an active 300,000 daily users which has increased revenue assurance, contact tracing, trip planning and management and easy payment process.

We achieved a milestone of over 15 billion naira in transactions in 2022.

VICTORIA AGBAMORO

Cowry Mobile App and Card

Cowry is a payment platform that supports the use of wallet and card to pay for bus

Let’s make it happen

Contact me today!

Let’s make it happen

Contact me today!

VICTORIA AGBAMORO